A businessman of my acquaintance once interrupted a conversation about economic cycles to proclaim, “Good times, bad times, it doesn’t matter. I always make money.” His company had the balance sheet to back up this claim, and as the old saying goes, it ain’t boasting if you can do it. I’ve often reflected on that conversation over the years, because it helped me to understand something important about the struggle between the public and private sectors.

Every nation has a mixture of rich people, poor people, and some form of middle class. There is some degree of circulation between these economic groups. A poor worker might earn enough to advance into the lower middle class, while a middle-class professional could become rich… or suffer a reversal of fortune that leaves him in poverty. This basic situation exists under every form of government, from free-market capitalism to fascist dictatorships. What changes under different systems is the composition of the upper class, and the size of the lower and middle classes.

Collectivists sell their politics with a promise of “equality,” generally understood by their audience as a promise to redistribute the wealth of the rich to improve the lives of the poor… but this is a lie. The upper class in a communist, fascist, or socialist government is fantastically wealthy. Most of the “redistribution” comes at the expense of the middle class, which shrinks as the lower class grows. Every form of collectivist government, including twenty-first century American socialism, declares war on the middle class, or tries to lure them into submission with promises of benefits.

The middle class provides most of the funding for Big Government, and feels the pinch of high taxes more than rich people, who can often find ways to avoid them. A ten percent loss of income hits people struggling to make car payments much harder than it hits millionaires. The middle class inevitably grows tired of being milked for funding, responds quickly to economic downturns that compromise its lifestyle, and has enough voting power to destroy political parties.

Socialists love to posture as enemies of the rich, but in truth, the upper class is not usually a big obstacle to their plans. They are happy to cooperate willingly, if they see advantages to gaining the favor of a command economy. They can profit from government policies that hurt smaller competitors much more than they hurt the biggest of the big dogs, or restrict access to markets where they already dominate.

The rich often find themselves rewarded with official power under a collectivist government, smoothy transitioning from respected businessmen into honored members of the ruling Party, or government consultants. Sometimes the upper class finds the thrill of power, and the indulgence of their ego, well worth a few million lost in the rusty gears of a contracting statist economy. If worst comes to worst, the collectivists know that the rich are a small group with little voting power, easily overwhelmed at the polls by an aroused population.

The desperately poor are generally reliable supporters of socialist politics. Someone who pays no taxes will understandably tend to support endless expansion of government benefits. Eventually, members of the working poor may come to realize their own prospects suffer when too much economic damage is sustained by those who employ them. It follows that high rates of long-term unemployment will generally increase the size of the dependency class, which produces more political rewards for statists who promise hefty government benefits… and extracting resources from the economy to pay for those benefits causes the economy to contract further, producing more unemployment. Unemployment is a malignant tumor.

Who are the rich? With a few trust-fund, sports, and Hollywood exceptions, the rich are people like that businessman of my acquaintance: they always make money. It has been said that if you gathered all the money in America into a single pot, then divided it evenly between every citizen, in a few years the same people would be rich and poor again. No matter how limited or activist the government might be, the same people tend to end up at the top. The most dramatic changes occur in the middle and lower classes… the people who don’t always make money. They can’t evade higher taxes, or turn draconian government regulations to their advantage. They depend on economic growth to produce jobs for them, or create the conditions necessary for them to launch profitable small businesses.

Collectivist politicians have much to gain by increasing the size of the dependency class. The fundamental political purpose of State-controlled health care is to transform much of the middle class into the lower class. The economic damage from spending trillions of dollars on a monstrous new government program in the middle of a recession is a feature, not a bug. A middle class dependent on the benevolence of the State for its health care will become less troublesome, less independent, and less able to begin the climb into the upper class through small business formation. Fewer small businesses means fewer working poor rising into the middle class.

To liberals who are not politicians, but involved citizens who sincerely care about their less fortunate neighbors, I would say that the temptation to redistribute from the rich to the poor is the tragic pursuit of a mirage. You will never draw real blood from the makers of money, and even if you could, it would never be enough to purchase “social justice.” Redistribution always slides from the middle class to the poor… and the result is, inevitably, more poverty plus a smaller middle class. Look at how the stock market fluctuates under the current Administration, while unemployment remains high. The markets can adjust and recover, because they are filled with people who always find ways to make money. When circumstances force those people to employ strategies that do not promote job growth and capital formation, the livelihood of the middle class suffers, and the ambitions of the working poor drop dead.

Sunday, November 29, 2009

Friday, November 27, 2009

Lose $80 on a Netbook With $180 Times Reader Subscription

You've gotta spend money to make money, at least according to the New York Times. The paper has entered the hardware subsidization business, offering $100 off the Samsung Go with $180 Times Reader subscription. [NYT via Business Wire via Engadget]

Send an email to Mark Wilson, the author of this post, at mark@gizmodo.com.

Wednesday, November 25, 2009

3 Ways to Make More Money with Amazon’s Affiliate Program This Christmas

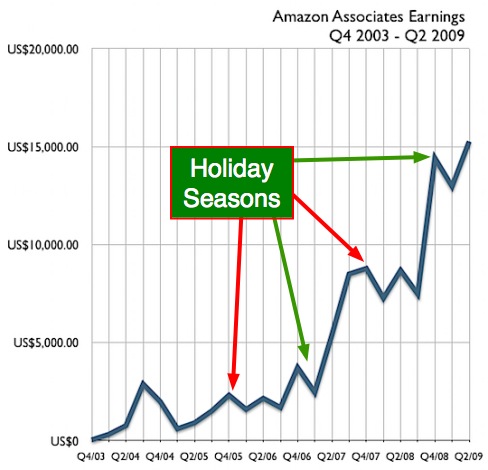

In that post post I posted a version of the following chart of my Amazon Associates earnings:

In the previous version of the chart I didn’t highlight the holiday seasons but I did want to point it out explicitly now as we are currently in one of the key times of year if you’re an Amazon affiliate (or for many other affiliate programs).

As you’ll see in the chart – all but one of the 4th Quarters that I’ve been promoting Amazon have been record periods for me. From what I can see – while the economy is certainly down at the moment – this current quarter looks like being yet another record for me.

I post this chart for one reason and it is this….

If you’re going to promote Amazon this Christmas – you’ve got to start now. The buying season has started. Yesterday I saw a big day of sales on Amazon and the kinds of products being bought indicate to me that much of it is gift buying.

In the coming week we’re going to see Christmas shopping start in earnest with some of the post Thanksgiving sales that stores like Amazon put on. As a blogger – you need to be positioning yourself to capitalise on this buying.

Here’s three things that you should do:

1. Get People in the Door – Amazon optimizes its site brilliantly to convert people into buyers who enter the site – so your goal is to get people in the door and let Amazon do its job of converting people. This doesn’t mean just linking to anything – you want to keep your links into the store relevant – but if you’re going to do some reviews or promotions of Amazon products – now’s the time

2. Watch What Amazon is Promoting – at this time of year Amazon puts on a variety of sales and runs specials on many products. Keep an eye on products in your niche, watch for what they are promoting and when they promote something relevant to your industry – take advantage of that opportunity to point it out to your readers.

3. Run Christmas Related Posts – this is a great time of the year to put together a few posts that highlight lists of products related to your readers. 10 Stocking Stuffers for Photographers will be a post on DPS in the coming week (based upon this question that I asked my readers). You don’t want to let this kind of thing over run your blog but a few fun posts like this both gets people in the door at Amazon but also gets them thinking about buying and in the buying mood.

There are plenty more tips in my previous post on making money with Amazon Associates Program (and the followup post) but those are three that I think are particularly relevant for this time of year.

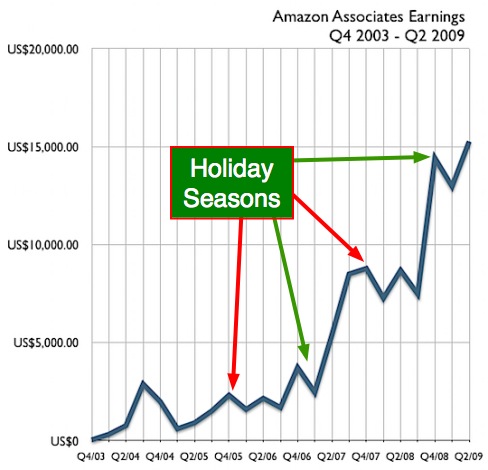

In the previous version of the chart I didn’t highlight the holiday seasons but I did want to point it out explicitly now as we are currently in one of the key times of year if you’re an Amazon affiliate (or for many other affiliate programs).

As you’ll see in the chart – all but one of the 4th Quarters that I’ve been promoting Amazon have been record periods for me. From what I can see – while the economy is certainly down at the moment – this current quarter looks like being yet another record for me.

I post this chart for one reason and it is this….

If you’re going to promote Amazon this Christmas – you’ve got to start now. The buying season has started. Yesterday I saw a big day of sales on Amazon and the kinds of products being bought indicate to me that much of it is gift buying.

In the coming week we’re going to see Christmas shopping start in earnest with some of the post Thanksgiving sales that stores like Amazon put on. As a blogger – you need to be positioning yourself to capitalise on this buying.

Here’s three things that you should do:

1. Get People in the Door – Amazon optimizes its site brilliantly to convert people into buyers who enter the site – so your goal is to get people in the door and let Amazon do its job of converting people. This doesn’t mean just linking to anything – you want to keep your links into the store relevant – but if you’re going to do some reviews or promotions of Amazon products – now’s the time

2. Watch What Amazon is Promoting – at this time of year Amazon puts on a variety of sales and runs specials on many products. Keep an eye on products in your niche, watch for what they are promoting and when they promote something relevant to your industry – take advantage of that opportunity to point it out to your readers.

3. Run Christmas Related Posts – this is a great time of the year to put together a few posts that highlight lists of products related to your readers. 10 Stocking Stuffers for Photographers will be a post on DPS in the coming week (based upon this question that I asked my readers). You don’t want to let this kind of thing over run your blog but a few fun posts like this both gets people in the door at Amazon but also gets them thinking about buying and in the buying mood.

There are plenty more tips in my previous post on making money with Amazon Associates Program (and the followup post) but those are three that I think are particularly relevant for this time of year.

Tuesday, November 24, 2009

How and Why to Make Goldman Pay

By now everyone, even the NY Times front page, has noticed the huge multi-billion dollar profits posted by Goldman Sachs and others in the financial sector. Naturally, at a time when everyone else is hurting, the instinct is to stop them or make them pay the money back to the government. The first question is "Why should they?" The usual answer is because we bailed out the finance industry, and they shouldnt make such huge profits on the backs of the taxpayers. I am sympathetic to this argument on simple fairness grounds, but it is important to answer a second question: "If we hit them with a huge payment, are we cutting off our nose to spite our face?"

My answer to the first question is that there is plenty of reason to think that it is entirely wrong that the financial sector runs off with such huge piles of money. And my answer to the second is that even if the financial sector were to quit doing what they are doing because of new taxes, there is good reason to believe we might be better off rather than worse.

First, to the extent that they are relying on taxpayer money, there is a prima facie case for taking the money back. We didn't bail them out so they could make profits - though I doubt that a smaller level of profits would have provoked such negative reaction - and so long as their profits are less than the amount the taxpayers pumped into them either directly or indirectly (and so far they are) then I feel on perfectly good moral ground taking the money back.

But there is a bigger case than that to be made - the truly obscene levels of profits in the investment banking industry have ballooned since the financial deregulation that happened at the end of the Clinton Administration (Gramm-Leach-Bliley). There is no question that the deregulation allowed huge gains and improvements in efficiency that could never have been gained before. For the investment bankers and their clients it was clearly a great thing. But here is the rub: that group - investment bankers and their clients - are all of them in the upper 5% of the income distribution. And this 5% is the only group in the whole economy that saw sustained income gains over the past decade.

So, what we had is a reform that increased income markedly but most of us didn't get any of the increase. What we DID get was much higher risk and volatility, which is a polite way of saying we are taking the hit for the economic crash of 2008-09. Most of us could only gain from the financial boon by having a stock portfolio, but those arent looking to great right now. Even with the recent increases, we have only recouped 50% of the losses since the crash began. I, for one, would be very happy with less efficiency but more stability. Unlike investment bankers, I don't make money on a down market just as easily as an up market. (In the interest of honesty, I used to be one of them - In a previous incarnation I was a bond trader - I was in charge of one of the largest traded portfolios in the UK gilt market back in the mid-1980's) It is not at all obvious to me that the bottom 90% of the income distribution would be worse off today if we had never done the reforms of 1999, had forgone the GDP increases that resulted, and had a somewhat less efficient financial sector.

So, how to get the money back? I think it would be a great thing to have another income tax bracket in the USA. Why not just tax those guys at 50% on income over $5 or 10 million? Sure, they would try to evade the tax by moving income offshore but we have an IRS - we could pay to chase them down if they try anything fishy. OH NO, they will say. We cant possibly work as hard if you take half our money over $5 million! Fine. Don't. But I will bet that the Goldmanites will scramble just as hard for $8 billion as they did for $16 billion.

But lets face it, that isn't going to happen with our current crop of politicians. (Its socialism!!) So how about a windfall profits tax? Or even a permanent tax on federally backed too-big-to-fail financial institutions? After all, there is clearly a well defined logic to this last idea: If we are all on the hook if they mess up, then they should contribute to the Treasury in return. We economists call that "internalizing the externality." That is, if their activities have a costly undesirable side effect that doesn't show up on their books - and this would seem to be the case here - then the cure is to find a way to make those costs come back to them, so they act according to society's cost/benefit calculation rather than their own private one.

And finally, some advice for those of them who don't like it and throw the inevitable hissy fit: Dont let the door hit you on the way out. We have plenty of people lined up who would love to have your job.

My answer to the first question is that there is plenty of reason to think that it is entirely wrong that the financial sector runs off with such huge piles of money. And my answer to the second is that even if the financial sector were to quit doing what they are doing because of new taxes, there is good reason to believe we might be better off rather than worse.

First, to the extent that they are relying on taxpayer money, there is a prima facie case for taking the money back. We didn't bail them out so they could make profits - though I doubt that a smaller level of profits would have provoked such negative reaction - and so long as their profits are less than the amount the taxpayers pumped into them either directly or indirectly (and so far they are) then I feel on perfectly good moral ground taking the money back.

But there is a bigger case than that to be made - the truly obscene levels of profits in the investment banking industry have ballooned since the financial deregulation that happened at the end of the Clinton Administration (Gramm-Leach-Bliley). There is no question that the deregulation allowed huge gains and improvements in efficiency that could never have been gained before. For the investment bankers and their clients it was clearly a great thing. But here is the rub: that group - investment bankers and their clients - are all of them in the upper 5% of the income distribution. And this 5% is the only group in the whole economy that saw sustained income gains over the past decade.

So, what we had is a reform that increased income markedly but most of us didn't get any of the increase. What we DID get was much higher risk and volatility, which is a polite way of saying we are taking the hit for the economic crash of 2008-09. Most of us could only gain from the financial boon by having a stock portfolio, but those arent looking to great right now. Even with the recent increases, we have only recouped 50% of the losses since the crash began. I, for one, would be very happy with less efficiency but more stability. Unlike investment bankers, I don't make money on a down market just as easily as an up market. (In the interest of honesty, I used to be one of them - In a previous incarnation I was a bond trader - I was in charge of one of the largest traded portfolios in the UK gilt market back in the mid-1980's) It is not at all obvious to me that the bottom 90% of the income distribution would be worse off today if we had never done the reforms of 1999, had forgone the GDP increases that resulted, and had a somewhat less efficient financial sector.

So, how to get the money back? I think it would be a great thing to have another income tax bracket in the USA. Why not just tax those guys at 50% on income over $5 or 10 million? Sure, they would try to evade the tax by moving income offshore but we have an IRS - we could pay to chase them down if they try anything fishy. OH NO, they will say. We cant possibly work as hard if you take half our money over $5 million! Fine. Don't. But I will bet that the Goldmanites will scramble just as hard for $8 billion as they did for $16 billion.

But lets face it, that isn't going to happen with our current crop of politicians. (Its socialism!!) So how about a windfall profits tax? Or even a permanent tax on federally backed too-big-to-fail financial institutions? After all, there is clearly a well defined logic to this last idea: If we are all on the hook if they mess up, then they should contribute to the Treasury in return. We economists call that "internalizing the externality." That is, if their activities have a costly undesirable side effect that doesn't show up on their books - and this would seem to be the case here - then the cure is to find a way to make those costs come back to them, so they act according to society's cost/benefit calculation rather than their own private one.

And finally, some advice for those of them who don't like it and throw the inevitable hissy fit: Dont let the door hit you on the way out. We have plenty of people lined up who would love to have your job.

Monday, November 23, 2009

Banks Finding "Sneaky Ways" to Make Money out of Public - Which? Report

UK-based Which? has recently released a report, and according to its banks all over the country are finding "sneaky ways" to make more and more money out of the unsuspecting public, including charging unexplained fees. Which? has been quick to assert that the rate on authorized bank overdrafts is currently at its highest level since the 1990s.

Recent official figures shared by the Bank of England have revealed that the current average rate of overdraft is 18.96%, but many big and renowned banks have been known to charge more. Owing to a major Supreme Court ruling, the number of unauthorized overdrafts has fallen considerably, and Which? has now accused banks of unnecessarily raising rates on authorized overdrafts to make up for the difference which has appeared as a result.

"It is like a balloon", shared Phil Jones of Which? "When you push in one part, it comes out in another. So we see that the banks are consistently taking sneaky ways tomake money out of people".

The whole country is now eagerly waiting for a Supreme Court judgment, post which millions of bank customers will be in line for payout worth a whopping 6 Billion Pounds. The ruling is awaited on whether or not the Office for Fair Trading can investigate the legality of unusually high overdrafts charges which have not been authorized.

(Via TopNews United Kingdom)

Recent official figures shared by the Bank of England have revealed that the current average rate of overdraft is 18.96%, but many big and renowned banks have been known to charge more. Owing to a major Supreme Court ruling, the number of unauthorized overdrafts has fallen considerably, and Which? has now accused banks of unnecessarily raising rates on authorized overdrafts to make up for the difference which has appeared as a result.

"It is like a balloon", shared Phil Jones of Which? "When you push in one part, it comes out in another. So we see that the banks are consistently taking sneaky ways tomake money out of people".

The whole country is now eagerly waiting for a Supreme Court judgment, post which millions of bank customers will be in line for payout worth a whopping 6 Billion Pounds. The ruling is awaited on whether or not the Office for Fair Trading can investigate the legality of unusually high overdrafts charges which have not been authorized.

(Via TopNews United Kingdom)

Sunday, November 22, 2009

How To Make Money From Your Own Finance-Related Blog

In this modern era most internet users are familiar with blogs because whichever subjects you may be interested in, you are bound to have come across several niche-specific blogs. However in this article I want to talk about how you can make money from your own blog, and finance-related blogs in particular.

Financial blogs are very popular because they can incorporate a wide range of different subjects such as stock market investing, saving, mortgages, loans, credit cards, forex trading, etc. Therefore you are unlikely to run out of things to talk about.

The trick is to pick a subject in this very large niche that you are most interested in. This will ensure that you don't end up getting bored with your blog and giving it up altogether. If you are still constantly adding content to your blog in several years time, it is highly likely that you will be making a decent amount of money at that point, because you will have hundreds of pages of content showing up in the search engines.

So how can you make money from your blog?

Well there are three main ways. The easiest way is simply to add pay-per-click ads to your blog, either in the header or sidebars, or within the actual content itself. Most people use Google Adsense but there are other programs you can use. The great thing about this method is that you earn money every time a visitor clicks on one of these ads, so your profits really start building up once you start getting a decent amount of traffic, particular in the finance niche where advertisers are prepared to pay several dollars per click in some instances.

An alternative way to make money is to sell advertising space directly to specific advertisers. This will usually generate additional income because you don't have to share your revenue with a third-party network. However you do have to actively find these advertisers yourself.

The final method is to use your blog to sell products and services as an affiliate. In other words sell other people's products and earn a commission for each sale that you generate. This can be highly lucrative, particularly in the finance blog because there are lots of different offers you can promote such as trading courses, bank accounts, mortgages, loans, credit cards, etc.

So as you can see there are several ways you can make money from running your own finance-related blog. I personally prefer the affiliate marketing model, but it's worth testing each method out to see which is the most profitable method for you because every blog is different.

Saturday, November 21, 2009

How Mozilla Makes Money and Why It Had Better Start Exploring Other Options.

A post on ZDNet today took me back to when I first considered how web browsers like Firefox made their money.

A post on ZDNet today took me back to when I first considered how web browsers like Firefox made their money.Many believe that Mozilla, known generally as an “open source” alternative to the likes of Internet Explorer, survives and thrives off donations. That is not the case. While the Mozilla Foundation does accept donations, Firefox , Thunderbird, Seamonkey and it’s other products are part of The Mozilla Corporation.

The Mozilla Corporation is a wholly owned subsidiary of the Mozilla Foundation and unlike the non-profit Mozilla Foundation, the Mozilla Corporation is a taxable entity. It reinvests some or all of its profits back into the Mozilla projects. The Mozilla Corporation’s stated aim is to work towards the Mozilla Foundation’s public benefit to “promote choice and innovation on the Internet.

So how does it make money. In one word, Google. Mozilla makes money by partnering with the likes of Google who pay Mozilla a publicly undisclosed amount for each Google search query made from Firefox by a user, reportedly between $50 to $100 million a year.

Hence why you’ll find Google as Firefox’s default search engine on its default homepage, and top right search bar.

Mozilla’s predecessor, Netscape, was also available for free but did not have the benefit (at the time) of a paying search partnership.

It’s unclear whether Mozilla has another revenue-generating option from within the browser itself, but what is for certain is that according to audited PDF of Mozilla’s financial results approximately 91% and 94% of Mozilla’s revenue for 2008 and 2007, respectively, came from Google.

With Google now promoting their own browser (and OS), Mozillaneeds to get thinking fast and exploring other revenue earning options. Of course, if Microsoft were to step in and offer Mozilla a hefty sum to replace Google as default search engine, then things might just get very interesting indeed.

Friday, November 20, 2009

Five Ways to Use (Green) Data to Make Money

If you put an energy meter inside a home and show people total usage in real time, a miraculous thing happens: they use about 10 percent less energy. The simple act of placing data in front of people changes their behavior. Data makes people smarter and inspires them to make small changes to save money and energy. You can use this powerful tool in business not only to cut costs, but to drive innovation and revenues.

Some are calling this phenomenon the "Prius effect," referring to how people respond when they see real-time fuel-efficiency data while driving the popular Toyota hybrid. As the described it, the Prius effect "can change driving in startling ways, making drivers conscious of their driving habits, then adjusting them to compete for better mileage." Similarly, making footprint data more accessible to those managers that can do something about it can create real value. As they say, you can't manage what you don't measure. It's amazing how often I hear that phrase — and how often people need to hear it. Tech leaders will tell you that one of the best possible solutions to the rapid increase in energy use and cost in data centers is simple: Add the power bill to the CIO's budget!

You can put your green data to use in five ways that will help your bottom line:

1. Saving money — a lot of it. As we've seen, if you give your operational people information on resource use, they will be inspired to find ways to cut back.

2. Driving internal competition. Share footprint data broadly and transparently and you'll see how badly people like to win. When PepsiCo Chicago ran a floor-by-floor energy reduction competition, the results were staggering. In one three-month period, electricity use dropped 17% (and paper use 22%). Energy use on the winning floor plummeted 31%. Factory heads at a number of companies have told me that they'd rather miss their financial targets than their green or energy goals — it's just too embarrassing to be at the bottom of the list.

3. Answering your customers' pressing questions. Wal-Mart, along with many other companies, is asking suppliers and vendors very tough questions about their environmental and social impacts. Those that can gather their data and tell the best story will get the most shelf space and mind space (see my previous post on Wal-Mart's eco-ratings for more on this point).

4. Prioritizing initiatives. Resources remain very tight — you don't want to spend money on the wrong things. With all the pressure to go green, it's easy to get lost in the weeds and pursue avenues that may not yield the most benefit. When companies really look at their full value-chain impacts, they're very often surprised at the results. Green leader Stonyfield Farm discovered that 95% of the ecological damage from its packaging occurred during production and distribution. So the company has made light-weighting (which is what it sounds like) the top priority — use less stuff and the footprint goes down. Stonyfield has made the deliberate choice to not use a recyclable, yet heavier, plastic; this counterintuitive and seemingly non-green choice makes the most environmental and fiscal sense given the real data.

5. Finding new market openings and focusing innovation. Procter & Gamble went through a similar lifecycle exercise and made a similar discovery about its laundry products. The vast majority of energy use was not in sourcing, production, or distribution, but in the use of the detergent in homes. And the majority of that was not the washing machine turning, but heating the water. This insight led to Tide Coldwater, a reformulated product to help customers wash in cool water, using less energy and saving money. Coldwater is one of P&G's seven original "sustainable innovation products" that generated $2 billion in sales in the first year.

Operating your business without environmental and social metrics leaves part of your management "dashboard" blank. How well can you run your company without complete information? But don't worry — you're not that far behind if you don't have a perfect handle on your value-chain footprint, or even your direct impacts. It's getting easier and easier to gather this data, and you can accomplish a great deal with even "back of the envelope" calculations.

Some are calling this phenomenon the "Prius effect," referring to how people respond when they see real-time fuel-efficiency data while driving the popular Toyota hybrid. As the described it, the Prius effect "can change driving in startling ways, making drivers conscious of their driving habits, then adjusting them to compete for better mileage." Similarly, making footprint data more accessible to those managers that can do something about it can create real value. As they say, you can't manage what you don't measure. It's amazing how often I hear that phrase — and how often people need to hear it. Tech leaders will tell you that one of the best possible solutions to the rapid increase in energy use and cost in data centers is simple: Add the power bill to the CIO's budget!

You can put your green data to use in five ways that will help your bottom line:

1. Saving money — a lot of it. As we've seen, if you give your operational people information on resource use, they will be inspired to find ways to cut back.

2. Driving internal competition. Share footprint data broadly and transparently and you'll see how badly people like to win. When PepsiCo Chicago ran a floor-by-floor energy reduction competition, the results were staggering. In one three-month period, electricity use dropped 17% (and paper use 22%). Energy use on the winning floor plummeted 31%. Factory heads at a number of companies have told me that they'd rather miss their financial targets than their green or energy goals — it's just too embarrassing to be at the bottom of the list.

3. Answering your customers' pressing questions. Wal-Mart, along with many other companies, is asking suppliers and vendors very tough questions about their environmental and social impacts. Those that can gather their data and tell the best story will get the most shelf space and mind space (see my previous post on Wal-Mart's eco-ratings for more on this point).

4. Prioritizing initiatives. Resources remain very tight — you don't want to spend money on the wrong things. With all the pressure to go green, it's easy to get lost in the weeds and pursue avenues that may not yield the most benefit. When companies really look at their full value-chain impacts, they're very often surprised at the results. Green leader Stonyfield Farm discovered that 95% of the ecological damage from its packaging occurred during production and distribution. So the company has made light-weighting (which is what it sounds like) the top priority — use less stuff and the footprint goes down. Stonyfield has made the deliberate choice to not use a recyclable, yet heavier, plastic; this counterintuitive and seemingly non-green choice makes the most environmental and fiscal sense given the real data.

5. Finding new market openings and focusing innovation. Procter & Gamble went through a similar lifecycle exercise and made a similar discovery about its laundry products. The vast majority of energy use was not in sourcing, production, or distribution, but in the use of the detergent in homes. And the majority of that was not the washing machine turning, but heating the water. This insight led to Tide Coldwater, a reformulated product to help customers wash in cool water, using less energy and saving money. Coldwater is one of P&G's seven original "sustainable innovation products" that generated $2 billion in sales in the first year.

Operating your business without environmental and social metrics leaves part of your management "dashboard" blank. How well can you run your company without complete information? But don't worry — you're not that far behind if you don't have a perfect handle on your value-chain footprint, or even your direct impacts. It's getting easier and easier to gather this data, and you can accomplish a great deal with even "back of the envelope" calculations.

Thursday, November 19, 2009

Invest and make money from Yamaha Gold

LONDON (Commodity Online): Is it worth buying Yamaha (NYSE:AUY)? SmarTrend, a proprietary pattern recognition system, called an uptrend for Yamana Gold on November 06, 2009 at $11.96. Since then, Yamana Gold has returned 10.1% as of today's recent price of $13.17.

SmarTrend called an Uptrend for Yamana Gold (NYSE:AUY) on July 20, 2009 at $9.74. Since then, Yamana Gold has returned 24.7% as of today's recent price of $12.15.

Following is an analysis on Yamaha Gold, published in Commodity Online sometime back:

Even as analysts have been predicting a rash of takeovers within the gold sector, as strong gold prices have helped larger miners raise funds, there are some biggies who are actually shutting the door and bolting it. Like Yamana Gold which has actually cut back on its assets, a concept that runs counter to the general thinking in the gold sector that more is better.

For the junior players, their slow number continues to play, given that the aftershocks of last year’s resource selloff and tight credit markets have kept valuations very low.

Rather than add projects, the Toronto-based company agreed in June to sell three of its higher-cost mines in Brazil and Honduras to exploration company Aura Minerals for about $200-million to focus instead mining and discovering more “high-quality”, low-cost ounces at its other properties spread throughout Latin America.

Chief executive Peter Marrone, who built the company into a mid-tier player through a series of takeovers in 2006 and 2007, has shut the door on further acquisitions, saying the company’s current assets are more attractive than anything on the market.”It is not part of our strategic plan,” Marrone said. “We’ve outlined what the growth plan of the company is and we’re going to continue with that growth plan. It is completely organic.”

The company has also backed away from its past prediction of reaching 2 million ounces of annual production by 2012, a boast that used to be standard in its news releases. Indeed, its outlook seems a lot more modest now, with expected output of about 1.2 million ounces this year, down from previous forecasts of 1.3 million to 1.4 million.

SmarTrend called an Uptrend for Yamana Gold (NYSE:AUY) on July 20, 2009 at $9.74. Since then, Yamana Gold has returned 24.7% as of today's recent price of $12.15.

Following is an analysis on Yamaha Gold, published in Commodity Online sometime back:

Even as analysts have been predicting a rash of takeovers within the gold sector, as strong gold prices have helped larger miners raise funds, there are some biggies who are actually shutting the door and bolting it. Like Yamana Gold which has actually cut back on its assets, a concept that runs counter to the general thinking in the gold sector that more is better.

For the junior players, their slow number continues to play, given that the aftershocks of last year’s resource selloff and tight credit markets have kept valuations very low.

Rather than add projects, the Toronto-based company agreed in June to sell three of its higher-cost mines in Brazil and Honduras to exploration company Aura Minerals for about $200-million to focus instead mining and discovering more “high-quality”, low-cost ounces at its other properties spread throughout Latin America.

Chief executive Peter Marrone, who built the company into a mid-tier player through a series of takeovers in 2006 and 2007, has shut the door on further acquisitions, saying the company’s current assets are more attractive than anything on the market.”It is not part of our strategic plan,” Marrone said. “We’ve outlined what the growth plan of the company is and we’re going to continue with that growth plan. It is completely organic.”

The company has also backed away from its past prediction of reaching 2 million ounces of annual production by 2012, a boast that used to be standard in its news releases. Indeed, its outlook seems a lot more modest now, with expected output of about 1.2 million ounces this year, down from previous forecasts of 1.3 million to 1.4 million.

Monday, November 16, 2009

How to make money in this market.

It's really easy:

1) Find companies with declining earnings growth and buy: ANF for example would be a nice example

2) Find companies that are downgraded. The dip is a chance to put new money to work.

3) Buy cult stocks. APPL and AMZN. There is always a greater fool you can sell them to.

4) Buy luxury retail. The fat cats on Wall Street are making free $ and they are spending it at Tiffany's

5) Buy a bank, leverage it to buy a bunch of other banks, and when it fails extort the taxpayer.

6) Buy stocks with high P/E ratios. Valutaions are meaningless. Party like it's 1999 or 2007

7) Avoid stocks in important industries. Refiners are a value trap. The fact that they often trade at less than book is no bargain.

8) Get on Goldman Sach's insider huddle list. You get the info first and can front run. WHo careas about the SEC?

9) Use insider information and buy blatant options days before major announcements. The SEC can't be bothered with investigating crimes. They've got luncheons to attend.

10) Get on Goldman Sach's trading team. They've made money a stunning 99.9 % of the trading days this year. Shamelessly. Now that's doing God's work. While you're there say hllo to Santa Claus, the Easter Bunny, and any leperchaun's you will see there. And pick that needle out of the haystack there too.

11) Threaten the government that our last vital industry (the financial services industry) will destroy the economy if we don't borrow trillions of dollars from our children and grandchildren to keep the above party going After all, we've got a FIRE to keep going here!!!

12) Do the opposite of what I do. Do not short sell overvalued stocks in overcapacitised industries like retail, finance, or insurance. Fighting free money from the government is a fool's game.

13) Do the opposite of what makes sense. Think a stock is overvalued? So do thousands of other common sense investors. Don't short it. Buy it. It's going higher until it squeezes each and every one of the shorts out.

14) Think a stock is undervalued and has a great future? Don't bother. Without a direct subsidy of cheap money from the government, nobody can get affordable financing. We are in business to reward the inneficient and punish innovation.

15) As unemployment rises...buy more stocks. As long as the fundamentals are bad, remember the Fed's moral hazard is in full play. Bad fundamentals means more borrowed government money on the backs of our children to keep this swell party going in the hopes we all feel rich and start spending money again.

16) Vote Democrat. They're in bed with Wall Street.

17) Vote Republica. They're in bed with Wall Street.

They just change the sheets when the door revolves.

Welcome to America 2009. I idn't make any money this year...did you? Only if you did the opposite of me.

1) Find companies with declining earnings growth and buy: ANF for example would be a nice example

2) Find companies that are downgraded. The dip is a chance to put new money to work.

3) Buy cult stocks. APPL and AMZN. There is always a greater fool you can sell them to.

4) Buy luxury retail. The fat cats on Wall Street are making free $ and they are spending it at Tiffany's

5) Buy a bank, leverage it to buy a bunch of other banks, and when it fails extort the taxpayer.

6) Buy stocks with high P/E ratios. Valutaions are meaningless. Party like it's 1999 or 2007

7) Avoid stocks in important industries. Refiners are a value trap. The fact that they often trade at less than book is no bargain.

8) Get on Goldman Sach's insider huddle list. You get the info first and can front run. WHo careas about the SEC?

9) Use insider information and buy blatant options days before major announcements. The SEC can't be bothered with investigating crimes. They've got luncheons to attend.

10) Get on Goldman Sach's trading team. They've made money a stunning 99.9 % of the trading days this year. Shamelessly. Now that's doing God's work. While you're there say hllo to Santa Claus, the Easter Bunny, and any leperchaun's you will see there. And pick that needle out of the haystack there too.

11) Threaten the government that our last vital industry (the financial services industry) will destroy the economy if we don't borrow trillions of dollars from our children and grandchildren to keep the above party going After all, we've got a FIRE to keep going here!!!

12) Do the opposite of what I do. Do not short sell overvalued stocks in overcapacitised industries like retail, finance, or insurance. Fighting free money from the government is a fool's game.

13) Do the opposite of what makes sense. Think a stock is overvalued? So do thousands of other common sense investors. Don't short it. Buy it. It's going higher until it squeezes each and every one of the shorts out.

14) Think a stock is undervalued and has a great future? Don't bother. Without a direct subsidy of cheap money from the government, nobody can get affordable financing. We are in business to reward the inneficient and punish innovation.

15) As unemployment rises...buy more stocks. As long as the fundamentals are bad, remember the Fed's moral hazard is in full play. Bad fundamentals means more borrowed government money on the backs of our children to keep this swell party going in the hopes we all feel rich and start spending money again.

16) Vote Democrat. They're in bed with Wall Street.

17) Vote Republica. They're in bed with Wall Street.

They just change the sheets when the door revolves.

Welcome to America 2009. I idn't make any money this year...did you? Only if you did the opposite of me.

Friday, November 13, 2009

Make Money Online - Free Home Business Kit Teaches Online Google Success

To make money online there are several rules you must follow, you should also have an amount of patience and time to spare. However, if you are willing to spend a little time and invest in some useful knowledge its likely that you will succeed.

When we talk about making money online there are various ways in which you can do this, many use Ebay to generate full time incomes selling popular products. The only trouble is with this is that you need a constant supply of popular products which you can get cheap to make a profit. This is not always easy done and there is massive competition so the profit will probably be very low.

When we talk about making money online there are various ways in which you can do this, many use Ebay to generate full time incomes selling popular products. The only trouble is with this is that you need a constant supply of popular products which you can get cheap to make a profit. This is not always easy done and there is massive competition so the profit will probably be very low.

Thursday, November 12, 2009

In the real world, charities need to spend money to make it

The charity funding debate is in the spotlight - hallelujah! Let's air this question of need and how we as a nation fill it. We should take an issue such as face-to-face fund-raising and look at all sides of this ''coin'' - realising, of course, that coins have three sides, not just two.

What are the three sides of face-to-face fund-raising? Well, there is the disgruntled public side. That's the view of the person who is - very reasonably - outraged that part of a donation might go somewhere other than the end cause. Why weren't they told of this cost of fund-raising? If they don't have a real stake in this, who does?

Then there is the view of charities using this revenue approach. That's the perspective that is - also reasonably - passionate about finding new supporters and smart enough to know that ongoing, long-term funding is vital for those their organisation serves. They are ordinary people managing extraordinary feats on the smell of the proverbial oily rag.

Finally, like the ridged side of the coin joining the two faces, there is the industry standpoint that is - very reasonably - divided on face-to-face fund-raising: effective tool or damaging to people's views on giving?

Why are all stances reasonable and how can they be reconciled?

It is understandable the community feels aggrieved. The Centre for Philanthropy and Nonprofit Studies undertook the Giving Australia study in 2005. We spoke with groups nationwide about their charity views and heard generous, caring voices wondering why charities couldn't be completely volunteer-run. Figures such as 10 per cent were the most that people felt should go on fund-raising and administration.

Then someone in the group would point out that the charity where they volunteered had taken huge strides when it employed some specialists. The zeroes in its annual income multiplied. Add more focus and firepower and you get more results, they said. More research, more people off the street. So the group came to think you might have to spend some money to make some. But they were rightfully cranky about not being told the real cost of raising funds. Charities, they said, are woeful communicators.

It is understandable that charities are embracing face-to-face fund-raising if it is working for them. For some, this newer approach has revolutionised their income.

People seldom give spontaneously. We know from Giving Australia that people who plan their giving donate four times as much as those who don't. Thoughtful giving and signing up for a monthly donation has to be planned.

Charities told us that people think any spending to make money is squandering. The reality is - no matter how generous we might be after a tsunami or bushfire - most Australians give because someone asks them to. We are brimful of good intentions but it takes a prompt for most of us to turn that into good action. Should that be someone on a street corner? Maybe - if they stick to the Fund-raising Institute Australia code, if they are ''quality controlled'' so they are true advocates for the community good, even if it is across a few different charities. Personally, I can't agree with the commission angle - they are doing a job and should be paid but not on commission; this method might breed pressure. Giving should be joyful, not guilt-filled.

In that vein, we need to invest cheerfully in a good result for the causes we care about. That means some of my donation will go to making the charity strong and able to do its job, not just to the pointy end of the business.

Just as I don't want a half-good electrician wiring my house, I don't want a half-good charity looking after the causes close to my heart. I want a strong, efficient but, more importantly, effective organisation, properly staffed - but hopefully still with more volunteers than paid staff. I want it to make a real and continuing difference, one that is not likely to go down the gurgler because it lacks sustainable funding.

That means agreeing to pay those who can win those funds, whether that is on staff or through a good consultant. I am happy to let the charity look after how my donation is spent to ultimately help the cause. I am extra pleased if they are transparent about where the different parts of my dollar go.

To sum up: there is charity utopia - and there is Australia in 2009. In the ideal world, everyone would keep what they need and the rest would flow magically to those who could do with it. No greasing of overseas officials' palms, no costs of getting dollars to where they can make a difference, no payment to backpackers to raise charity funds, just a seamless compassion pipeline.

Life - and the charity pipeline - isn't like that. Australians are generous, we help a mate, but our taxes and our donations still aren't touching all the deep needs and opportunities out there. In that climate, we will face new ways of being asked to support. If we don't like them, we should speak out. We should demand transparency. In return, we should understand the other side of the coin. Maybe with that understanding, more of us might join those who add more of their coin to their favourite charities each month. It could be our own personal compassion pipeline.

Dr Wendy Scaife is a senior research fellow in the Australian Centre for Philanthropy and Nonprofit Studies at Queensland University of Technology.

What are the three sides of face-to-face fund-raising? Well, there is the disgruntled public side. That's the view of the person who is - very reasonably - outraged that part of a donation might go somewhere other than the end cause. Why weren't they told of this cost of fund-raising? If they don't have a real stake in this, who does?

Then there is the view of charities using this revenue approach. That's the perspective that is - also reasonably - passionate about finding new supporters and smart enough to know that ongoing, long-term funding is vital for those their organisation serves. They are ordinary people managing extraordinary feats on the smell of the proverbial oily rag.

Finally, like the ridged side of the coin joining the two faces, there is the industry standpoint that is - very reasonably - divided on face-to-face fund-raising: effective tool or damaging to people's views on giving?

Why are all stances reasonable and how can they be reconciled?

It is understandable the community feels aggrieved. The Centre for Philanthropy and Nonprofit Studies undertook the Giving Australia study in 2005. We spoke with groups nationwide about their charity views and heard generous, caring voices wondering why charities couldn't be completely volunteer-run. Figures such as 10 per cent were the most that people felt should go on fund-raising and administration.

Then someone in the group would point out that the charity where they volunteered had taken huge strides when it employed some specialists. The zeroes in its annual income multiplied. Add more focus and firepower and you get more results, they said. More research, more people off the street. So the group came to think you might have to spend some money to make some. But they were rightfully cranky about not being told the real cost of raising funds. Charities, they said, are woeful communicators.

It is understandable that charities are embracing face-to-face fund-raising if it is working for them. For some, this newer approach has revolutionised their income.

People seldom give spontaneously. We know from Giving Australia that people who plan their giving donate four times as much as those who don't. Thoughtful giving and signing up for a monthly donation has to be planned.

Charities told us that people think any spending to make money is squandering. The reality is - no matter how generous we might be after a tsunami or bushfire - most Australians give because someone asks them to. We are brimful of good intentions but it takes a prompt for most of us to turn that into good action. Should that be someone on a street corner? Maybe - if they stick to the Fund-raising Institute Australia code, if they are ''quality controlled'' so they are true advocates for the community good, even if it is across a few different charities. Personally, I can't agree with the commission angle - they are doing a job and should be paid but not on commission; this method might breed pressure. Giving should be joyful, not guilt-filled.

In that vein, we need to invest cheerfully in a good result for the causes we care about. That means some of my donation will go to making the charity strong and able to do its job, not just to the pointy end of the business.

Just as I don't want a half-good electrician wiring my house, I don't want a half-good charity looking after the causes close to my heart. I want a strong, efficient but, more importantly, effective organisation, properly staffed - but hopefully still with more volunteers than paid staff. I want it to make a real and continuing difference, one that is not likely to go down the gurgler because it lacks sustainable funding.

That means agreeing to pay those who can win those funds, whether that is on staff or through a good consultant. I am happy to let the charity look after how my donation is spent to ultimately help the cause. I am extra pleased if they are transparent about where the different parts of my dollar go.

To sum up: there is charity utopia - and there is Australia in 2009. In the ideal world, everyone would keep what they need and the rest would flow magically to those who could do with it. No greasing of overseas officials' palms, no costs of getting dollars to where they can make a difference, no payment to backpackers to raise charity funds, just a seamless compassion pipeline.

Life - and the charity pipeline - isn't like that. Australians are generous, we help a mate, but our taxes and our donations still aren't touching all the deep needs and opportunities out there. In that climate, we will face new ways of being asked to support. If we don't like them, we should speak out. We should demand transparency. In return, we should understand the other side of the coin. Maybe with that understanding, more of us might join those who add more of their coin to their favourite charities each month. It could be our own personal compassion pipeline.

Dr Wendy Scaife is a senior research fellow in the Australian Centre for Philanthropy and Nonprofit Studies at Queensland University of Technology.

Subscribe to:

Posts (Atom)