Forget what you might have heard: Journalists can earn money publishing online. Here are some tips from OJR readers.

This article is designed to help journalists learn how to make extra money, or even a full-time wage, by publishing independently online. It is not intended to provide an online revenue model for established news organizations. Heck, they've got business managers. They shouldn't need a wiki to show them what to do.

Content websites typically earn money through one of four ways:

* Commissions / Affiliate links

* Advertising networks

* Selling your own ads

* Paid content

* Sponsorships/Grants

Once you have ads on your site, you will want to compute the eCPM (effective cost per thousand impressions) of revenue that each ad type is earning for you. You calculate eCPM by taking the total amount generated by an ad (or ad type), diving it by the number of pages on which that ad (or ad type) appears, then multiplying by 1,000. Let eCPM data help you decide which advertising type, layout and position work best for you.

Commissions / Affiliate links

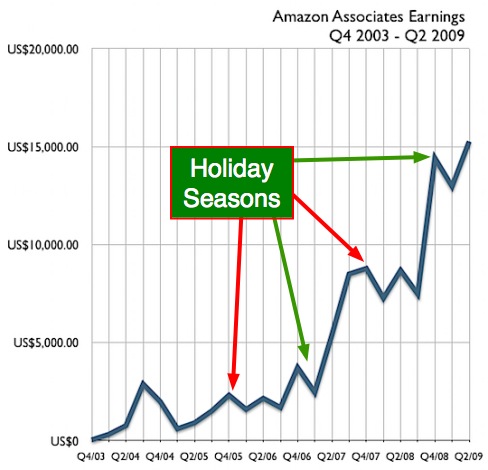

Affiliate programs, such as Amazon.com's Associates Program, provided the first ways for early solo and small Web publishers to make a few bucks on their websites. In these programs, an online retailer will pay you, the publisher, a percentage on sales made after customers click through from your website to the retailer's site. Links can include traditional banner ads, search forms and links to individual products.

Because you only earn money when sales are made, affiliate programs will work best for you if your site's readers are consistently looking to make high-priced purchases -- for example, if you run a product review site. If you're interested in affiliate program, browse through merchant directories like Commission Junction and LinkShare to find retailers that offer products that fit your site's topic and audience.

Once registered with a merchant's program, you can create an ad or product link on your site using a snippet of Web code downloaded from the retailer. Some merchants go further and allow you to create virtual storefronts that match the design of your site, but where the retailer still handles all the inventory and commerce. Be careful setting up such arrangements -- unless you want customers coming to you for return and refund questions instead of to the retailer.

You'll want to note what percentage of a sale the retailer pays back to you, as well as the length of time after a sale that you get credit for the purchase. Some retailers limit credit to sales made on the initial click-through, but others will give credit for any sales made within a day or so. Also, some retailers will pay a commission on purchases you personally make after clicking your own links; others may kick you out of the program for doing that. Check a retailer's affiliate agreement and shop around for what you consider the best deal before putting links on your site.

Many publishers have found that links to individual products return more commissions than banner ads going to a retailer's home page. But the additional money those links earn might not be enough to justify the extra time that selecting and maintaining them requires.

Advertising networks

Most news websites earn the bulk of their money through advertising. But you don't need a sales staff to attract advertisers to your site. Ad networks can handle the sale and display of ads on your site. All you need do is drop a few lines of code into your Web pages where you want the ads to appear.

The most popular ad network for independent publishers is Google's AdSense program. AdSense is a "pay per click" (PPC) program, where you earn money each time one of your readers clicks on a Google-served ad. Since you earn money on clicks, rather than completed sales, PPC ad networks can provide a more reliable source of income for sites whose readers are not looking to make a purchase right away. Other notable PPC ad networks include the Yahoo! Publisher Network and Ad Voyager.

Most PPC ads are text, but some PPC networks also sell image and Flash ads. Ads are sold and displayed based on an auction system, where advertisers bid on selected keywords and phrases that appear on network websites. The ad network looks for webpages displaying its ad code, then matches what it determines the content of a webpage to be with the most appropriate keywords and phrases that advertisers have bid upon. The network then automatically weighs several factors in determining which ads to serve on the page, including the value of those bids; advertisers' remaining budgets for those bids; what percentage of readers have clicked on those ads in the past; and, in Google's case, the percentage of those readers who have made a purchase or read a designated number of pages on the advertiser's site.

Google's "Smart Pricing" program will adjust the amount paid to you for each click based on your readers' track record of making a purchase, or viewing a certain number of pages, on that particular advertiser's website. So if your site attracts motivated buyers, you remain in the best position to earn money.

Whatever you do, do not even think about clicking the ads on your site, or encouraging your readers to do the same. All PPC ad networks prohibit click fraud, and will boot from their program any publisher found to be inflating their number of clicks. Even well-intentioned discussion board participants can get a publisher booted from the program by encouraging other readers to click the ads to support the site. Google, for example, has suggested publishers concerned about their readers' conduct add this disclaimer to their site:

"Your postings to this site may not include incentives of any kind for other users to click on ads which are displayed on the site. This includes encouraging other readers to click on the ads or to visit the advertisers' sites, as well as drawing any undue attention to the ads. This activity is strictly prohibited in order to avoid potential inflation of advertiser costs."

If you don't think PPC ad networks will work for you because your site's target audience is defined by demographics, such as geography or a religious or political affiliation -- don't worry. Traditional ad networks such as BlogAds provide an alternative to the PPC networks. BlogAds sells its ads on a more traditional site-targeted model. Advertisers do not bid on keywords or phrases, but instead pay for their ads to be displayed a certain number of times on selected websites or groups of websites. BlogAds has become especially popular on political blogs, where advertisers can buy across a group of liberal or conservative weblogs.

Design to maximize online ad revenue

Since PPC ad networks target their ads primarily by topic, rather than geography or demographics, that makes these networks work better with niche topic websites than with sites that target their readers by geography or other demographics, such as gender, education, income or political affiliation.

For the system to work well for you, the PPC network's spiders must be able to determine a topic for each of your webpages and then must match keywords or phrases that advertisers have bid upon. That means the advantage goes to websites where each page covers a distinct and easily identifiable subject. So if you have a blog that covers a mishmash of topics on a single URL, you won't elicit the targeted ads that lead to high-paying clicks.

If you want to use PPC ad networks, organize your content to limit individual URLs to a specific topic. Break long blogs into individual entries. Archive old posts and stories by subject matter, not just by date and author. Stay active on discussion boards, keeping threads on topic and directing folks to more relevant pages should they stray toward other subjects. Use keywords in headlines, decks and URLs whenever possible. And spell out keywords, phrases and proper names on first reference, rather than using acronyms throughout the piece. (See, old fashioned copy editing rules *can* help you make money!)

Well-organized pages on individual topics also show up better in search engine results, attracting Web surfers curious about a specific keyword, who are more likely to click on a targeted ad. Publishers who create evergreen articles that are likely to attract a high number of links and clicks over time will do best in attracting search engine traffic to their ad-supported webpages. If you publish time-sensitive articles, which are not likely to have a long-enough shelf life to attract significant search engine traffic, consider swapping out or archiving articles on the same topic to a single URL, so that URL can get linked to and picked up in search results.

Where you place ads on a page affects how many of your users see them, and click. According to recent Google research, top performing ad formats include:

* Large box ads placed in the middle of your main content column;

* Skyscraper ads placed in a left-side column;

* Leaderboard ads placed at the top and the bottom of the main content column.

Customize the ads' colors to match the background, type and navigational colors of your site, too, to eliminate "banner blindness" and maximize their visibility to your readers.

Then keep an eye on your ads to make sure that they remain relevant to your site. To a reader, ads -- like anything else on your pages -- are part of the content of your website. If an ad network fails to deliver consistently relevant ads, dump it and try something else. Respect your readers by not bombarding them with irrelevant advertising and they will respect you by continuing to read your site.

Think twice before installing pop-up, pop-under and screen "take-over" ads, too. Many readers steer clear of sites that block their access to the content they're looking for with aggressive advertising. Keep your website a safe haven for these ad-weary readers and you can build its audience over time.

How much traffic do you need?

With advertising, the more readers you have and page views you serve, the more money you can make. But how much traffic do you need to make a living from your website?

To make $36,500 a year, you'd need to earn $100 a day on your site (plus whatever expenses you incur). Let's assume your site is attractive to advertisers and earns $10 in ad revenue for every thousand page views. That would mean you'd need to serve 10,000 page views a day to meet this target. (And more if your site earns less than $10 per thousand page views.)

How can you attract that much traffic? If you are writing one article a day on subjects that will be out of date within 24 hours, it's going to be tough. You'll need to attract nearly 10,000 views each day for that's day article, since few people will bother reading your old, out-of-date work. If you write a fair number of "evergreen" features, which keep attracting page views long after they are written, you'll find the task much easier. If your site naturally deals with "perishable" news content, at least publish each day's new news to the same URL, overwriting or pushing down the old content, so that URL can build the in-bound links and search engine traffic that will help you attract new readers you need each day.

Reader-contributed content can also help you meet your page view goals. Well-managed, thoughtfully organized discussion boards and wikis can add dozens of new content pages a day to your site, with much less effort on your part than writing that many original articles.

Selling your own ads

If you don't want to share your ad revenue with a network, or if your site isn't the type to do well with PPC ads, you might consider selling space directly to advertisers.

First, you will need solid information about your site's visitors. Ultimately, what you are selling to advertisers is access to your readers, so you'd better know how many, and who, they are. A traffic tracking service like Google Analytics can provide accurate trafiic data that filters out hon-human traffic like search engine spiders and automated robots (which can account for up to 90 percent of a site's overall traffic). Make Money also provides reader tracking, along with some crude demographic information about your site's readers.

You should also consider conducting a survey of your readers, to get more detailed information about their demographics and behavior. SurveyMonkey provides easy-to-use tools to set up such surveys.

Once you have advertisers, you will need a system to serve and manage ads, such as OpenAds, as well as system to invoice your advertisers, such as Blinksale or PayPal. (PayPal's invoicing system does not require your advertisers to have a PayPal account, just a credit card.)

Set up a page on your site, linked from the header or footer, that provides data about your site's traffic and visitors, as well as a list of available ad packages. You might also provide a well-designed PDF version of the same data, as decision-makers often prefer "hard copy" versions of this information. (If you need free software to convert Word documents to PDFs, OpenOffice does this with a single mouse click.)

If your advertising page does not generate enough leads to support your site, you'll need to make cold calls to potential advertisers, via e-mail, phone or in person. You'll have the best luck with smaller businesses that do not place ads through agencies, but where the owner makes his or her own ad decisions.

Paid content

Given the variety and depth of information available on the Web, you have to provide truly unique content of high value to specific readers to get those readers to pay for it. The fact that a paid journalist wrote an article for you does not mean it's worth paying for to a reader. Detail-oriented publications such as Consumer Reports and Cook's Illustrated have had success selling the results of their independent testing online. And, of course, porn sites have been earning big bucks from paid content since the Web's earliest days. But general-interest publications, such as the Los Angeles Times, have found that walling off content to paid subscribers has generated less revenue than the company could have earned by selling advertising on freely available pages.

If you are certain that your content is unique and valuable enough that readers would be willing to pay for it, you'll need to select a way to handle payments from your readers. The system could be as easy as asking readers mail you a check in exchange for your putting them on e-mail content distribution list -- a method which offers the advantage of not requiring any advanced Web server security set-up. Or you could restrict access to certain folders on your website to readers whom you assign log-ins after they buy a subscription. Such restrictions are relatively easy to set up on Apache webservers. Payment can be handled manually via postal mail or phone, or automatically through an e-commerce storefront. (Many Web hosting packages include e-commerce storefronts.)

Sponsorships/Grants

Supporting a website through sponsorship or grants requires the least technical skill of these options, but the most interpersonal skills. You'll need to play the role of a salesperson, in addition to journalist and editor, in convincing a individual or organization to give you money to put up your site.

In either case, you'll need to identify individuals, or individuals within organizations, who might be willing to commit their money, or their organization's money, to your site. You'll need to make a written proposal, and often, an in-person pitch, and follow through until you secure your funding. Grants typically require a more structured application process than sponsorships, which can be sold through a formal solicitation or over drinks at the dinner table, depending upon whom you are working with.

The University of Iowa provides some guidance and a collection of links on grant writing in general, including links to many organizations which grant funds to researchers and publishers.